management

Pooling benefits

Revenue

optimization

World wide trading, minimizing ballast times and identifying the best yielding markets

Credit & bi monthly distributions

Credit lines totaling US$225m support optimisation and allow for bimonthly pool earning distributions

Working capital

optimisation

Pool membership reduces vessel working capital requirements for owners

Strong

cargo base

Pools' fleet size and diversity ensures Navig8 is among the top tonnage providers to oil majors and leading commodities traders

Counterparty risk diversification

Pool revenue aggregation and a robust credit risk management framework heavily mitigate the counterparty risk profile

Transparent &

Standardized reporting

Online web platform provides comprehensive reporting, analysis and audited financial statements

Navig8 pools

The Navig8 Pools offer ship owners a wide range of value adding benefits

| POOL | VL8 |

|---|---|

| TYPE | VLCC |

| DWT | 300,000+ |

| VESSELS | |

| POOL | SUEZ8 |

| TYPE | Suezmax |

| DWT | 120 - 200,000 |

| VESSELS | |

| POOL | V8 |

| TYPE | Aframax |

| DWT | 95 - 120,000 |

| VESSELS | |

| POOL | ALPHA8 |

| TYPE | LR2 |

| DWT | 95 - 120,000 |

| VESSELS | |

| POOL | LR8 |

| TYPE | LR1 |

| DWT | 65 - 79,000 |

| VESSELS | |

| POOL | ECO MR |

| TYPE | MR |

| DWT | 44 - 54,000 |

| VESSELS |

| POOL | TYPE | DWT | VESSELS |

|---|---|---|---|

| VL8 | VLCC | 300,000+ | |

| SUEZ8 | Suezmax | 120 - 200,000 | |

| V8 | Aframax | 95 - 120,000 | |

| ALPHA8 | LR2 | 95 - 120,000 | |

| LR8 | LR1 | 65 - 79,000 | |

| ECO MR | MR | 44 - 54,000 |

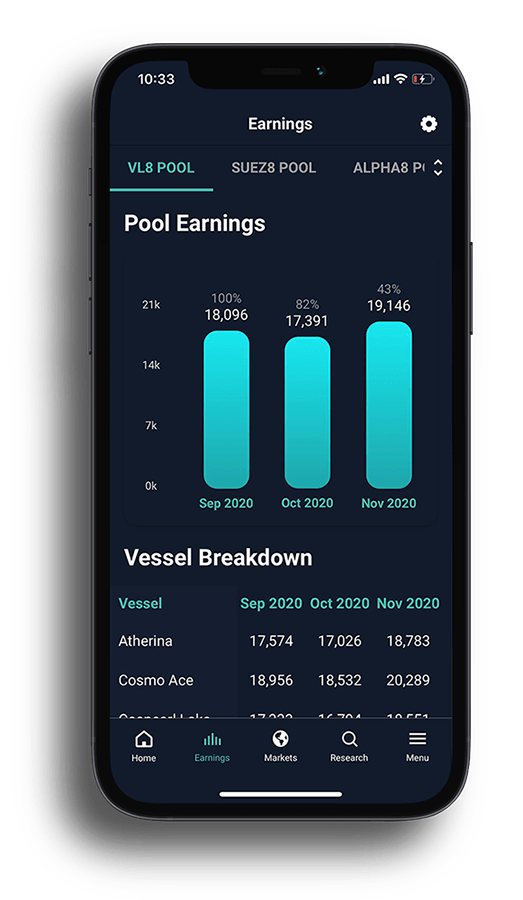

Web & Mobile reporting centre

The Navig8 Pools offer ship owners a wide range of value adding benefits

Pool & vessel earnings

Research Portal

Vessel passage data

Pool Reports & Documents

Daily chartering insights

Yearly Meetings

Pool & vessel earnings

Daily updates on current pool and vessel earnings published directly from our in house systems

Research Portal

In house research publications, analysis of market and industry drivers across all segments of the industry

Vessel passage data

Passage data for owners’ review and analysis. Easy access to latest performance reviews

Pool Reports & Documents

Weekly, monthly & quarterly performance reports. Overview of the spot and time charter markets, analysis of current oil trends

Daily chartering insights

Market snippets from our chartering desks across the globe

Yearly Meetings

Two commercial and one technical meeting held annually, allowing for discussion and networking

Commercial management

The Navig8 Pools offer ship owners a wide range of value adding benefits

Our focus on meeting customers’ transportation requirements has led us to offer unparalleled flexibility to oil majors and commodity traders, whose needs often span different markets, vessel segments, cargo types and quantities.

In addition to exclusive access to certain customers’ in-house cargo volumes, fleet development continues to be used strategically to build a contracted cargo base that provides additional structure to our trading network and support to the pool earnings base.

We continually extract optimal value from information flow to generate revenue outperformance. Our success, however, remains dependent on combining performance with reliable, high quality service and commercial flexibility.

We consistently back ourselves to deliver superior revenues for the pools, and evidence this by chartering in vessels for our own account. To date, we have concluded over 160 charter-in commitments.

This fulfils a number of functions: increased versatility to meet customers’ needs, enhancement of customer relationships plus support for pool development. It also supports our commercial management services and maximises pool earnings performance.

ipsum